gst services

Get Price Quote

Based in New Delhi, India, we are involved in offering dependable GST Services. We have a team of proficient individuals that help you in getting the GST done for your company. You can easily get your business compliant under GST by contacting us. We complete the documentation work and provide complete assistance to the clients in getting the GST certificate. Also, you can easily file periodic returns under our expert’s guidance.

Service Tax Return Filing Services

Get Price Quote

We are engaged in offering Service Tax Return Filing Services to our esteemed clients. With a team of diligent and highly professional accountants and tax agents, we offer error-free and high quality service. Our staff possesses immense expertise in this field and we uses the most recent technology software for providing our services and this ensures there is little duplication of work and higher accuracy. We cover services such as one time registration under service tax, assessment/reassessment procedures, quarterly/half-yearly/annual return filing, litigation support and service tax consultancy.

Looking for Indirect Tax Services Providers

GST Return Preparation Services

Get Price Quote

GST Registration, GST Compliances,GST Return Filing, Implementation of procedures and practices required for effective compliance with Goods and service tax requirements. Development of accounting and procedural manuals keeping in mind the GST framework

Indirect Taxation Services

Get Price Quote

With a motive to stand high on all the prospects of our patrons, we are engrossed in presenting Indirect Taxation Services. Widely appreciated by our customers, these services are provided by our experienced team members who are perfect in this field. We provide expert opinion on issues which are complicated and advise the clients on practical issues in service tax legislation. Furthermore, these can be purchased from us in different provisions as per the budget requisites of our respected customers. Detail : We provide pragmatic solutions for a variety of organizations including multi-national corporations, large Indian corporations and small and medium enterprises. In India, some of the significant Indirect Taxation regulations are: Service Tax (ST) regulations Value Added Tax (VAT)/ Central Sales Tax (CST) regulations Goods and Services Tax (GST) regulations Central Excise regulations Customs regulations Apart from the above, the following regulations are also closely associated with the Indirect Tax authorities and regulations : Special Economic Zone (SEZ) regulations Software Technology Parks of India (STPI) regulations 100 % Export Oriented Units (EOU) regulations Foreign Trade Policy (FTP) regulations A well planned indirect tax strategy is essential for competitive product pricing and ensuring increased profitability. Focus on Some of our significant services in the Indirect Tax domain include- Indirect Tax Advisory Services Business Structuring strategies – Advising on structuring / re-structuring the business / organization structure with a view to minimize the tax incidence and optimize available benefits as provided under the regulations. Transaction Advisory Services – Advising on structuring / re-structuring of transactions / relationships with a view to achieve the objectives of minimizing of tax and compliance impact. Preparation of Compliance Manuals / Standard Operating Policy and Procedure (SOP) Manuals – Assisting in the preparation of Standard Operating Policy and Procedure Manuals covering the various indirect tax compliance requirements – eg. policies, procedures, related templates for various forms, registers etc to be used of the organization based on specific customized needs of the Client. GST Change Management Study – Conducting a study to determine the extent of impact that the various changes being contemplated in the Goods and Services Tax (GST) regulations, could have on the various aspects of the business / organization pursuant to the transition from the existing tax regime to GST and advising on the possible strategies that would be required to be adopted to enable minimal effect of such impact. This exercise could broadly cover the following aspects : Formulating a GST Migration Steering Committee Impact study of GST on businesses Review of the existing level of compliance, documentation and accounts function with a view to identifying the changes that would be required Review of the Accounting systems as existing and the changes that would be required thereon in the new GST regime. Review of Information Technology (IT) systems as existing and the changes that would be required thereon in the new GST regime. Identifying various aspects that would need to be intimated / resolved / reconfirmed with Customers and Suppliers / Vendors. Studying implications of the change on the organizational cash flows. Assisting in the preparation of a detailed checklist for GST administration Identifying and examination of possible areas where there could be concerns of litigation / ambiguity and advising on related matters / strategies to be followed. Organizing intermediate and advanced training programs for groups of employees based on specific organizational needs. Understanding transitional GST provisions and advising / assisting clients in their proper understanding and availment of the benefits as permissible. Providing Opinions on specific matters – Examining specific matters / issues referred to by Clients and providing our specialized opinions thereon. Indirect Tax Compliance Audit Services Conducting Compliance Reviews – Critical review of key compliance and documentation aspects governing the various regulations (e.g. Service Tax, Central Excise, VAT/CST, Foreign Trade Policy, GST etc). Further, the review can also be extended to cover the internal control aspects in respect of the above regulations in the functions / departments of the organization. The said reviews can be conducted either on a one off basis or on a periodic basis (Concurrent / Monthly / Quarterly / Half Yearly) as per requirements of the Client. Compliance Services : Obtaining registrations, Approvals, TIN etc. from various regulatory authorities Assistance in filing of periodic returns Assisting in filing of refund claims with the authorities Cancellation of registrations, completion of closing assessments etc and related matters. Assisting in the compilation, analysis and representation of the matters before the Authorities during their non- routine visits to the Client's premises or during hearings where the Clients / their representatives are asked to represent. Representation before authorities for Refund Audits / Business Audits / Assessments. Preparation of filing of appeals / request for advance rulings etc and representing before the authorities. Coordination with Statutory VAT Auditors Any other related compliance matter where assistance is required.

Delhi Value Added Tax Registration Services

Get Price Quote

In year 2004, delhi government is introduced the law relating to levy of tax on sale of goods, tax on transfer of property involved in execution of works contracts, tax on transfer of right to use goods and tax on entry of motor vehicles. This scheme is known as delhi value added tax act, 2004 (herein after referred as ã��ã�â¢ã�â¯ã�â¿ã�â½ã�â¯ã�â¿ã�â½dvatã��ã�â¢ã�â¯ã�â¿ã�â½ã�â¯ã�â¿ã�â½) under this scheme, there are two type of registration: voluntary registration where a dealer intends to start his business in delhi, he may register himself under the voluntary scheme. It is not necessary for dealer who starts his business in delhi to get itself registered with the delhi value added tax department at the time of starting his business until his turnover in the current year exceeds rs 10,00,000. It is an optional registration. compulsory registration every dealer is required to apply for registration under this act if the dealers turnover in the preceding year or current year exceeded rs. 10,00,000. A dealer is also liable to pay tax, or is registered or required to be registered under central sales tax act, 1956 provided that a dealer dealing exclusively in goods mentioned in the first schedule shall not be required to register. explanation- for the purposes of this section, in case of dealers involved in execution of works contracts, the taxable quantum shall be calculated with reference to the total contract amount received. taxable turnover the taxable quantum of a dealer shall not include turnover from- a) sales of capital assets;- b) sales made in the course of winding up the dealers activities; and c) sales made as part of the permanent diminution of the dealers activities. time limit a dealer must apply for registration within 30 days from the date on which it becomes mandatory for him to get itself registered with the department by making an application in the prescribed dvat 04 form. in case of more than one place of business within delhi, the dealer needs to nominate any one such branch or place as its principal place of business and it is also necessary to mention all premises in the registration application.

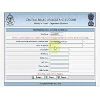

gst registration

Get Price Quote

Income Tax Registrations

Tax Audit services

Get Price Quote

Tax Audit services, risk management, Cost Control & Cost Reduction

Sales Tax Registration Services

Get Price Quote

Sales Tax Registration Services, Sales Tax Compliance Services

Service Tax Registration

Get Price Quote

Service Tax Registration, legal documents formation services

Income Tax E Filing Software services

Get Price Quote

Income Tax E Filing Software services, Palm Reader Machine

tax return

Get Price Quote

tax return, business accounting services, finance accounting services

online pan card services

Get Price Quote

online pan card services, pan card application, Atal Pension Yojana Details

central excise services

Get Price Quote

central excise services, Custom Services, tax consultants

Central Excise Law & Practice 25th Edition 2016

Get Price Quote

Central Excise Law & Practice 25th Edition 2016, Machine Drawing Book

Trademark Infringement Monitoring Service

Get Price Quote

Trademark Infringement Monitoring Service

Income Tax Registration

Get Price Quote

Income Tax Registration

Income Tax Return

Get Price Quote

Income Tax Return, Service Tax

Indirect Tax Services

Get Price Quote

Indirect Tax Services, company formation & business setup services

Tax Audit services

Get Price Quote

Tax Audit services, Concurrent Audit Services, statutory audit services